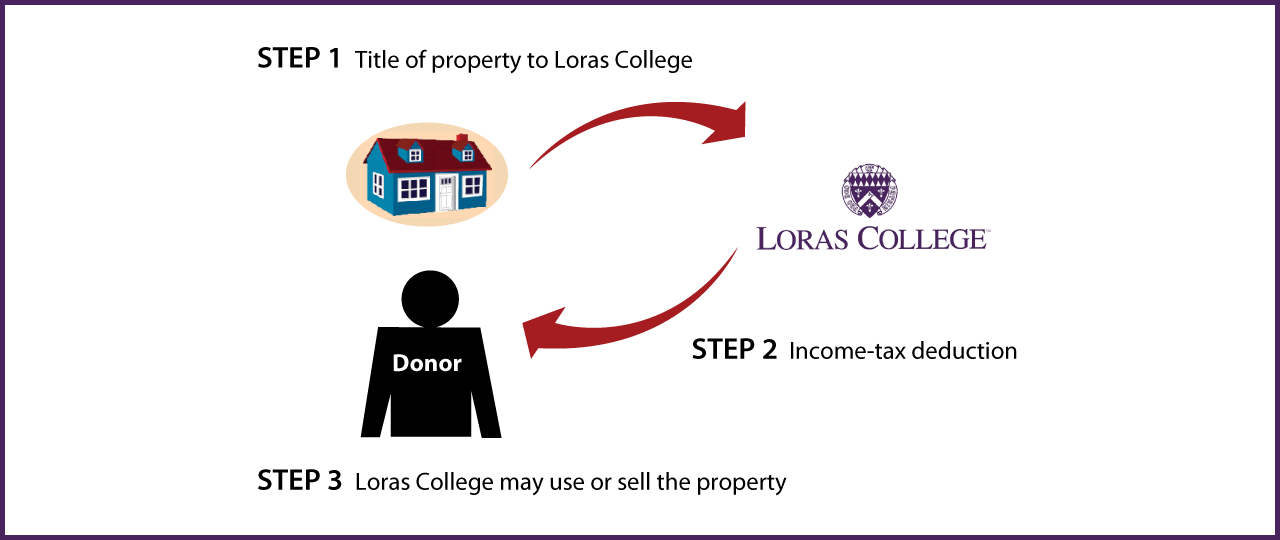

How It Works

- Transfer title of property to Loras College

- Receive income-tax deduction for fair-market value of property

- Loras College may use or sell the property

Benefits

- Income-tax deduction for fair-market value of property based on qualified appraisal

- Avoid capital-gain tax on appreciation in value of the real estate

- Relieved of details of selling property

- Significant gift to Loras College

Request an eBrochure

Request Calculation

Contact Us

Amy Bess

Associate Vice President for Institutional Advancement

Ph: 563-588-7969

amy.bess@loras.edu

Loras College

1450 Alta Vista Street

Dubuque, IA 52001

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer